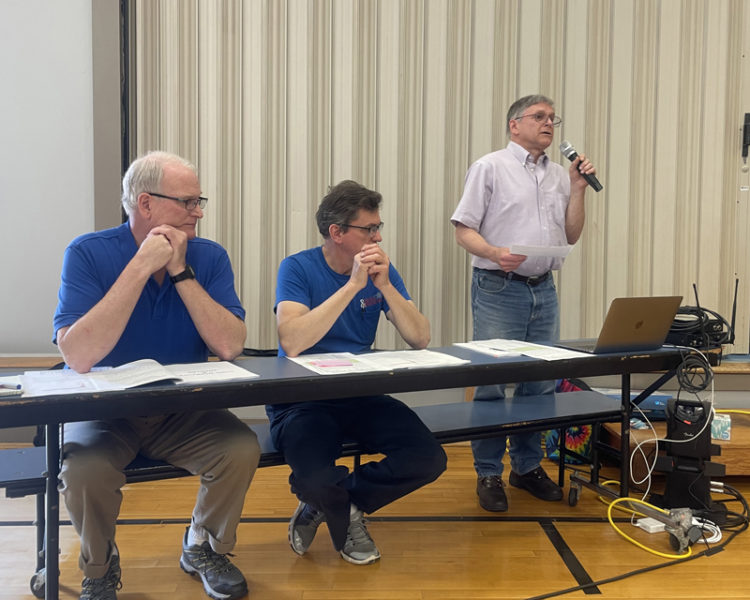

Somerville Select Board Chair Chris Johnson addresses the annual town meeting held in Somerville Elementary School gymnasium on Saturday, June 24. From left: select board members Donald Whitmer-Kean, Don Chase, and Johnson. (Sherwood Olin photo)

Despite the likelihood of a stiff mil rate increase this year, Somerville voters took a pragmatic approach while dispatching a 26-article warrant during a three-plus hour annual town meeting at the Somerville Elementary School on Saturday, June 24.

During the meeting, voters opted to add $30,000 in taxation, adding $10,000 to the roads budget and $20,000 to an article funding a fire department equipment reserve account. After the latter vote, Select Board Chair Chris Johnson advised the town their decisions were adding to the mil rate.

“I would like to make people aware that between this and the earlier amount we raised we are bumping up the mil rate by anther .5, .6 mils, so we are a little over a two and a half mil increase,” Johnson said.

Including the additional $30,000 in amendments, Somerville voters approved an $823,570 municipal budget, accepting a $175,288, or 27.03% increase from fiscal year 2023.

In a money-saving decision, the town voted not to pursue legal action against Hagar Enterprises Inc., for what the town warrant described as a “breach of promise regarding a warranty on Somerville Road paving.”

Somerville had taken issue with the performance of the Damariscotta-based contractor regarding the 2017 paving and 2018 reconstruction of Somerville Road. Hagar Enterprises agreed to fix issues with the road in the summer of 2020 under the town’s warranty for the work, but did not complete the repair.

The select board ultimately hired Ted Small of the Auburn firm Skelton, Taintor & Abbott to address the issue.

Warrant article 24 asked if the town wanted to file suit over the issue, and if so, what sum the town would vote to raise and appropriate to do so. The select board recommended against filing further legal action, citing property tax increases as a factor.

“If we proceed now, I think it’s going to be throwing more money at it without very good odds that we will gain a benefit that exceeds what we have to spend for money to do it,” Johnson said.

Taking article 24 out of order, the town consulted with Small for almost 40 minutes before agreeing to forego a lawsuit. Small, who spoke to the assembled via a Zoom call, advised litigation could easily exceed $100,000 or more; adding some potentially significant expenses could not be controlled by the town.

“What I can tell you is … you can’t get through a construction litigation, I don’t think, for less than $30,000, and that’s even a simple construction case,” Small said. “This would probably not be a simple construction case, so I think you would have to count on it being more expensive than that.”

Queried as to the realistic possibility of achieving a “positive outcome” for the town, Small said a positive outcome depended on what the town would be willing to accept as positive. Emphasizing that he was speaking in general terms, Small said litigants should never begin a legal action assuming chances of success were any better than 50/50.

“I am not tying that to very specific outcomes,” he said. “When you asked about a positive outcome, I am tying a 50/50 chance to getting some sort of outcome that might be viewed as positive to one degree or another.”

After an extended debate, voters rejected a budget committee proposal to take $10,000 from $20,000 in American Rescue Plan Act funds earmarked for the expansion of broadband in town and apply it to repair and maintenance of town roads.

The select board and budget committee split on their recommendations for the roads budget, with the difference being the $10,000 in ARPA funds. Voters ultimately opted for the budget committee’s higher recommendation of $417,156, accepting an $88,187, or 26.8% increase over fiscal year 2023, and amending the article to make up for the lack of ARPA funds through taxation.

As approved, the roads budget is funded by $23,916 in state local road assistance program funds, $16,000 from the capital road improvement account, and $377,240 raised from taxation.

Voters combined two funding articles for nonprofit agencies together and approved both without opposition: a $74,850 budget for the Somerville Volunteer Fire Department and a $3,840 article for 10 not-for-profit community organizations.

The agencies included Healthy Kids, Kennebec Valley Behavioral Health, Jefferson Area Food Bank, Midcoast Maine Community Action, New Hope Midcoast, Spectrum Generations, Waldo Community Action Partners, Windsor Rescue, and the Washington Fire Department.

Considering a proposed $10,000 article for a fire department equipment reserve account, Somerville Emergency Management Director and budget committee member Jon Amirault successfully motioned to amend the amount to $30,000. Amirault said Somerville is operating with an old fire truck which will eventually need replacing. Occasionally grant monies become available, one of which might require the town to provide matching funds.

“My thought was, and a few of us on the (budget) committee had thought as well, if we put a little more money in this cookie jar every year for the fire department, when a grant comes along, we’ll be able to have our end of the deal to get a new truck,” he said. “I think the alternative is to pretend our old truck is going to last forever and when it breaks we are going to have to borrow a bunch of money to get a new one.”

In other decisions, voters also approved raising and appropriating $15,641 for intergovernmental fees and $84,351 for long term debt. They also authorized the select board to appropriate $20,000 from surplus to meet unanticipated expenses, apply $102,500 in general fund revenues to reduce the property tax commitment, and set up a property tax payment plan.

According to the plan, the tax collector could enter agreements with individual taxpayers, in which the taxpayer agreed to pay a monthly sum based on the estimated and actual tax obligation. In return for a monthly payment schedule, the town would not charge interest.

By 26-5 written ballot, voters increased the property tax levy limit to account for the approved spending decisions.

Voters also approved on a proposed canine control ordinance as presented. Johnson said the ordinance was presented in response to concerns from the public. The specific language was closely modeled on Union’s ordinance, with a few minor changes.

“It has some consequences for people that are repeat offenders, basically,” Johnson said. “If someone is calling animal control just to aggravate their neighbors that have animals as opposed to a substantive claim each time, then it can be a nuisance complaint and they can be required to be paying fees for their animal control costs for dealing with such nuisance complaints.”